The Federal Reserve Bank of New York puts out a monthly publication called “U.S. Economy in a Snapshot,” a compilation of figures and short notes about the most recently available major macroeconomic statistics. As we take a deep breath and head into 2022, it seemed a useful time to consult pass along some these figures as as a way of showing the path of the US economy since the two-month pandemic recession of March and April 2020.

Here’s the path of GDP growth. It has clearly bounced back from the worse of the recession, but it still remains about 2% below the trend-line from before the recession occurred.

Part of the reason why GDP has not rebounded more fully lies in what is being called the “Great Resignation”–that is, people who left the workforce during the pandemic and have not returned. Just to be clear, to be counted as officially “unemployed” you need to be both out of a job and actively looking for a job. If you are out of a job but not looking, then you are “out of the labor force.” Thus, you can see that while the unemployment rate based on those out of a job and actively looking for work is back down to pre-pandemic levels, the labor force participation rate–which combines those who have job and the unemployed who are looking–has not fully rebounded. A smaller share of the labor force working will typically translate into a smaller GDP. When or if these potential workers return to the workforce will have a big effect on the future evolution of the economy and public policy.

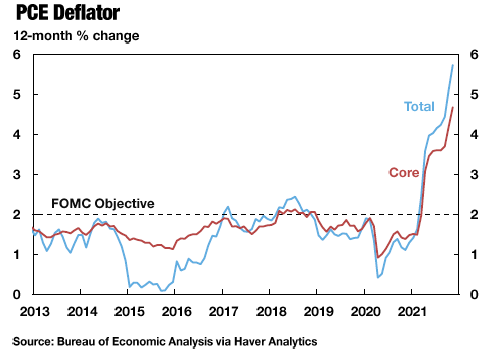

Meanwhile, inflation is a worry. The measure of inflation used by the Federal Reserve is called the Personal Consumption Expenditure deflator, which is preferred to the more familiar Consumer Price Index for a variety of technical reasons like broader coverage of consumer spending, although the two numbers move very much in synch. In particular, the Fed focuses on “core” inflation, which means stripping out any effects of energy and food prices. The thinking is that energy and food prices can bounce around a lot for reasons specific to those markets, so if you want to know about inflation spreading over the breadth of the economy, it’s more useful to look at everything else.

What’s interesting here is that inflation in prices of goods is leading the way, as opposed to inflation in prices of services.

During the aftermath of the pandemic recession, a lot of services industries were hindered by the need for greater in-person contact. Thus, while consumer spending on both goods and services has bounced back, the bounceback has been bigger for goods. If inflation can be roughly defined as too much money chasing too few goods, the demand in the economy has been chasing goods with more enthusiasm than it has been chasing services.

The patterns of real investment in the economy are not unexpected, but they are vivid. Business investment in equipment has spiked back to pre-pandemic levels. One suspect that a certain share of this equipment is what was needed for much greater online interaction.

However, business investment in structures has dropped a lot. With vacancies in business real estate apparent everywhere, the reasons to build more have diminished quite a bit.

On the residential side, there has been a boom in new building. One consequence of the aftermath of the pandemic is that a lot of what was formerly classified as “residential” real estate was quickly repurposed as, in effect, “commercial” real estate that was a common workplace. My suspicion is that this change is causing a lot of people to rethink their residential space: if it’s also going to be a workspace for extended periods, then maybe just planning to drop your laptop on the kitchen table is not a sufficient solution.

In the area of international trade, imports have bounced back, while exports have not. I haven’t seen a fully satisfactory breakdown of why this is so, but one reason is related to the resurgence in purchases of goods just mentioned–including goods with an imported component. Also, “imports” is a category that includes foreign tourism: that is, a US tourist buying German-made goods and services while visiting Germany is viewed as “importing” those goods, while a Japanese tourist buying US goods and services while visiting the US is counted as buying US exports. A surge of overseas US travel helped increase US imports, but there has not been a corresponding surge of tourists coming to the US.